How I Survived a Debt Crisis — Real Strategies That Actually Worked

I never thought I’d be drowning in debt — until I was. It started small: missed payments, growing balances, sleepless nights. Then came the calls, the stress, the feeling of being trapped. But I found a way out. Through real choices, not magic fixes, I rebuilt control. This is the story of how smart strategy — not luck — changed everything. If you’re struggling, what worked for me might work for you too. It wasn’t about sudden windfalls or cutting every pleasure from my life. It was about clarity, consistency, and making decisions that added up over time. This isn’t a fairy tale. It’s a roadmap — one built on real numbers, real trade-offs, and real results.

The Breaking Point: When Debt Becomes a Crisis

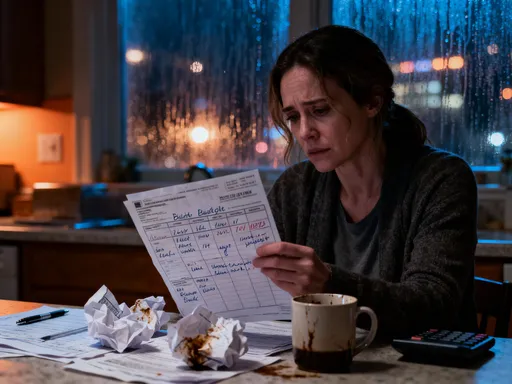

There was a moment — not dramatic, not cinematic — when I realized I could no longer pretend. I sat at my kitchen table, bills spread out like evidence at a trial, and added up the numbers for the first time in over a year. The total was more than I earned in ten months. Credit cards, medical bills, a personal loan I barely remembered signing — all of it had snowballed while I was busy living. I wasn’t reckless by nature. I had a steady job, paid rent on time, and even tried to save. But a car repair here, a family emergency there, and a habit of swiping a card without checking the balance had quietly pushed me over the edge.

What made it worse wasn’t just the money — it was the shame. I felt like I’d failed, like I was the only one who couldn’t handle basic adulthood. I avoided opening mail. I let calls from creditors go to voicemail. I stopped talking about money with friends, terrified they’d ask how I was doing and I’d have to lie. The emotional toll was heavier than the debt itself. Sleep became elusive. I’d wake up at 3 a.m. with my heart racing, mentally running through impossible calculations. I wasn’t just broke — I felt broken.

But that night at the kitchen table, something shifted. Denial had run its course. The weight of avoidance was worse than the truth. I didn’t have a solution yet, but I knew I had to stop pretending. I wrote down every debt, every creditor, every interest rate. I didn’t sugarcoat it. I didn’t blame anyone else. I just faced it. And in that moment, the crisis stopped growing — not because the numbers changed, but because I stopped feeding it with silence. That was the beginning of control.

Facing Reality: Mapping the Full Financial Picture

Once the initial shock wore off, the real work began. Recovery doesn’t start with action — it starts with awareness. I realized that guessing how much I owed, or pretending some bills didn’t exist, was like trying to navigate a storm without a compass. So I gathered every statement, logged into every account, and created a single document that listed every debt I carried. I included credit cards, medical balances, a small personal loan, and even the overdraft fees that had piled up. I recorded the current balance, the interest rate, the minimum payment, and the due date for each one. Nothing was left out.

This wasn’t just about numbers — it was about transparency. I needed to see the full picture, not a curated version. When I totaled it up, the figure was daunting: $28,470. That number sat on the page like a verdict. But oddly, seeing it in black and white was less terrifying than the vague dread I’d been carrying. At least now I knew the enemy. More importantly, I could start planning how to fight it.

I also reviewed my monthly income and expenses. I tracked every dollar that came in and went out for three full months. I used a simple spreadsheet — no fancy apps, no complicated tools. I categorized spending: housing, groceries, utilities, transportation, subscriptions, dining out, and miscellaneous. What surprised me wasn’t the big expenses — it was the small, automatic drains. A $15 subscription I never used. A $40 gym membership I hadn’t touched in months. Weekly coffee runs that added up to over $120 a month. These weren’t luxuries — they were habits. And habits, once seen, can be changed.

This phase wasn’t about judgment. It wasn’t about beating myself up for past choices. It was about gathering data. With clear numbers in front of me, I could make informed decisions. I knew how much I needed to save each month to cover basics. I knew how much wiggle room I had — or didn’t have. Most importantly, I could calculate how long it would take to pay off each debt if I only made the minimum payments. The answer: nearly 14 years, with over $12,000 in interest. That was unacceptable. But now, I had a starting point. And a starting point, no matter how painful, is always better than standing still.

Choosing the Right Strategy: Snowball vs. Avalanche vs. Consolidation

With the full picture in view, I faced a critical question: how to attack the debt? I’d heard about different methods — the debt snowball, the debt avalanche, consolidation — but I didn’t know which one would work for me. Each had its merits, and each came with trade-offs. I spent time researching, not just online, but talking to a nonprofit credit counselor who helped me understand the real-world implications. What I learned was that the best strategy isn’t the one that looks best on paper — it’s the one you can stick with.

The debt snowball method focuses on paying off the smallest balances first, regardless of interest rate. You list your debts from smallest to largest, throw extra money at the smallest one while making minimum payments on the rest, and once it’s paid off, you roll that payment into the next smallest. The benefit isn’t mathematical — it’s psychological. There’s power in crossing something off the list. That first win builds momentum. For someone feeling overwhelmed, that sense of progress can be the difference between giving up and pushing forward.

The debt avalanche, on the other hand, is the mathematically optimal choice. You pay off debts with the highest interest rates first, which minimizes the total interest paid over time. It’s efficient. It saves money. But it can be emotionally draining. If your highest-interest debt is also your largest, it might take months before you see any balance disappear. That lack of visible progress can sap motivation, especially in the early stages when you need it most.

Then there’s debt consolidation — combining multiple debts into a single loan with a lower interest rate. It can simplify payments and reduce monthly costs. But it’s not a magic fix. It only works if the new rate is truly lower and if you don’t run up new debt on the old accounts. I considered a balance transfer credit card with a 0% introductory rate, but I knew my discipline wasn’t perfect. If I couldn’t pay it off before the rate jumped, I’d be worse off. I also looked into personal loans, but my credit score had taken a hit, and the rates offered weren’t favorable enough to make a real difference.

In the end, I chose a hybrid approach. I used the debt snowball to build early momentum, focusing on two small medical bills totaling under $1,000. Paying those off in two months gave me a rush of confidence. Then, I switched to the avalanche method for the larger credit card balances, where interest was eating away at my progress. This wasn’t a rigid rule — it was a flexible strategy. I let my psychology and my math work together. The goal wasn’t to follow a textbook — it was to create a plan I could live with, one that balanced speed, savings, and sustainability.

Cutting Costs Without Killing Joy: Smart Spending Adjustments

One of the biggest myths about getting out of debt is that you have to live like a monk. I believed that for a while — that freedom meant sacrifice, that every dollar saved had to come from something I loved. But I quickly realized that extreme deprivation doesn’t last. If a plan feels miserable, you won’t stick to it. So instead of cutting everything, I focused on cutting what didn’t matter — and protecting what did.

I started with subscriptions. I had three streaming services, a meal kit delivery I used once a month, and a meditation app I hadn’t opened in six months. I canceled two of the three streaming platforms — keeping only the one with my favorite shows — and paused the others for three months to see if I missed them. I canceled the meal kit and the meditation app. That saved $68 a month with almost no impact on my life. I also switched my cell phone plan to a cheaper provider that used the same network. It took an hour of research and a 20-minute call, but it cut my bill in half — saving $45 a month.

Groceries were another area where small changes added up. I started planning meals weekly, making a list, and sticking to it. I stopped shopping when I was hungry — a simple rule that kept impulse buys in check. I bought store brands instead of name brands — the difference in quality was negligible, but the savings were real. I also started using cashback apps and digital coupons, which saved an average of $20 a week. Over a year, that’s nearly $1,000 — enough to wipe out a credit card balance.

I didn’t eliminate dining out — I just made it intentional. Instead of grabbing lunch three times a week, I limited it to once. I packed my lunch more often, using leftovers from dinner. I found joy in cooking at home, trying new recipes, and making it a relaxing part of my evening. I also negotiated bills I thought were fixed. I called my internet provider and asked for a better rate — and got it. I shopped around for car insurance and switched to a company that offered a lower premium for safe driving. These weren’t drastic moves, but together, they freed up over $300 a month — money that went straight to debt payments.

The key was framing these changes not as losses, but as choices. I wasn’t giving up — I was redirecting. Every dollar I saved wasn’t disappearing into a void. It was going toward freedom. And that made all the difference.

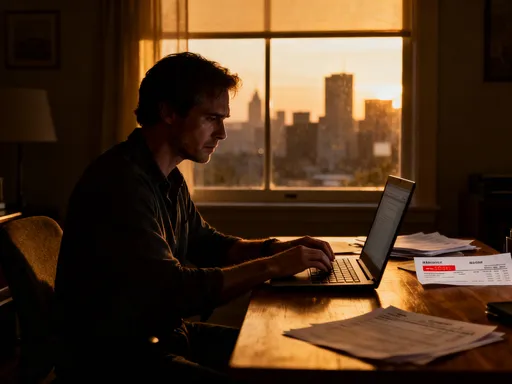

Boosting Income: Side Gigs, Skills, and Hidden Opportunities

Cutting expenses helped, but I knew it wasn’t enough. To get out of debt faster, I needed to earn more. I didn’t want to work a second full-time job — I had limited energy and time. But I realized there were ways to increase income without burning out. The goal wasn’t to get rich — it was to create a little extra breathing room, enough to accelerate my debt payoff.

I started by selling things I no longer used. I went through my closet, my garage, and my storage bin. Clothes I hadn’t worn in years, old electronics, books, even kitchen gadgets I had duplicates of. I listed them on online marketplaces and made over $800 in three months. It felt like finding money I didn’t know I had. I also held a garage sale and donated what didn’t sell — which came with a small tax benefit and the satisfaction of clearing space.

Then I looked at my skills. I had experience in writing and editing from a previous job. I created a simple profile on a freelance platform and started taking on small projects — blog posts, proofreading, resume editing. At first, I only worked a few hours a week, but it added $200 to $300 to my monthly income. I didn’t quit my day job. I didn’t need to. I used evenings and weekends, and I protected my rest. This wasn’t about hustle culture — it was about using what I already had to get ahead.

I also explored other low-barrier opportunities. I signed up for a survey site that paid small amounts for feedback — not much, but $15 a month for 30 minutes of work added up. I joined a local errand-running service and helped neighbors with grocery shopping and pet sitting. It wasn’t glamorous, but it was flexible and paid in cash. I even rented out a spare room on a short-term basis when a friend needed a place to stay — we agreed on a fair rate, and it covered my internet bill for two months.

The lesson wasn’t that side gigs are the answer for everyone. It was that there are always options — if you’re willing to look. You don’t need a viral business idea or a risky investment. You just need to be open to small, steady gains. Every extra dollar earned was a dollar closer to zero. And over time, those dollars became hundreds, then thousands. That extra income didn’t just pay down debt — it gave me hope.

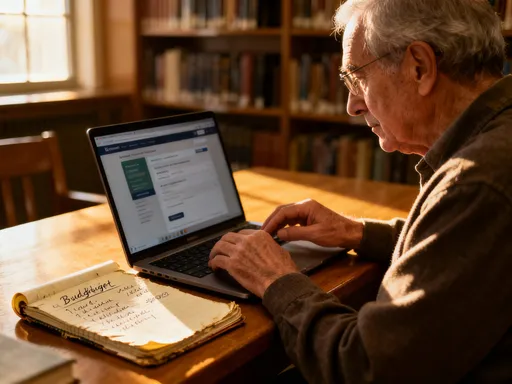

Protecting Progress: Building Emergency Funds and Avoiding Relapse

One of the biggest dangers after making progress is the temptation to go back to old habits. Once the stress of debt started to fade, I caught myself thinking, “I’ve got this under control now.” I almost made the mistake of celebrating with a big purchase — a new laptop I didn’t need, justified as a “reward.” That’s when I realized: financial recovery isn’t just about paying off debt. It’s about staying out of debt.

To do that, I knew I needed a safety net. Experts often say to save three to six months of expenses before paying off debt — but that’s not realistic when you’re already drowning. So I started small. I committed to saving $20 a week — less than $100 a month — in a separate savings account. It wasn’t much, but it was something. That account became my emergency fund. When my washing machine broke six months later, I didn’t panic. I didn’t put the repair on a credit card. I paid for it — $320 — from my savings. That small cushion prevented a new crisis.

I also changed how I thought about money. I stopped viewing my checking account as a place to spend from and started seeing it as a tool to manage. I used a simple budgeting method — the envelope system, digitally — where I allocated money to categories and tracked spending in real time. I celebrated small wins: paying off a card, hitting a savings milestone, going a month without a late fee. These weren’t just victories — they were proof that I was changing.

I also set up automatic payments for my remaining debts and savings. Automation removed the mental load and the temptation to skip a payment. I kept my credit cards — but I stopped using them for daily spending. I left them at home, used them only for emergencies, and paid the balance in full every month. I also reviewed my budget quarterly, adjusting for life changes like a pay raise or a new expense. This wasn’t a one-time fix — it was a new way of living.

The goal wasn’t perfection. It was resilience. I knew I’d make mistakes — we all do. But now, I had systems in place to catch them before they became disasters. That shift — from reactive to proactive — was the real breakthrough.

From Crisis to Control: Lessons That Last Beyond Debt

Today, I’m debt-free. Not because I got lucky. Not because I earned more. But because I made better choices — consistently, patiently, and with purpose. The journey took three years, not three months. There were setbacks, moments of doubt, and times I wanted to quit. But I kept going, one payment, one decision, one day at a time.

What I learned goes far beyond money. I learned that clarity is power. That facing the truth, no matter how hard, is the first step to change. I learned that small actions, repeated, create big results. I learned that discipline isn’t punishment — it’s freedom. And I learned that financial health isn’t about how much you earn, but how you manage what you have.

This experience reshaped my relationship with money. I no longer see it as something that controls me. I see it as a tool — one that, when used wisely, can build security, reduce stress, and create opportunities. I still budget. I still save. I still plan. But now, it’s not out of fear — it’s out of choice.

If you’re in debt, know this: you’re not alone. You’re not weak. You’re human. And you can change your situation — not overnight, but over time. Start where you are. Use what you have. Do what you can. The path out of debt isn’t about perfection. It’s about progress. It’s about making one smart decision after another, until the weight begins to lift. And when it does, you’ll realize something powerful: you didn’t just survive the crisis. You grew stronger because of it.